One more day and we’ll get another crack at deciphering chairman Bernanke’s cryptic phraseology. Will the Fed dial down QE spending?

One ‘monster’ indicator looks so bad, it’s good for stocks (bad news = more reasons to keep QE going strong).

Bernanke linked the quantity and longevity of QE directly to the labor market. The current headline unemployment rate is at 7.6%, down from 10% in October 2009.

Although the headline number is moving in the right direction, many smart people have pointed out that this is only a statistical improvement caused by a shrinking workforce.

Adjusted for population, fewer Americans now work than at any other time since 1979. The improving number also doesn’t reflect workers that had to settle for jobs that only pay a fraction of their pre-crisis salary/income.

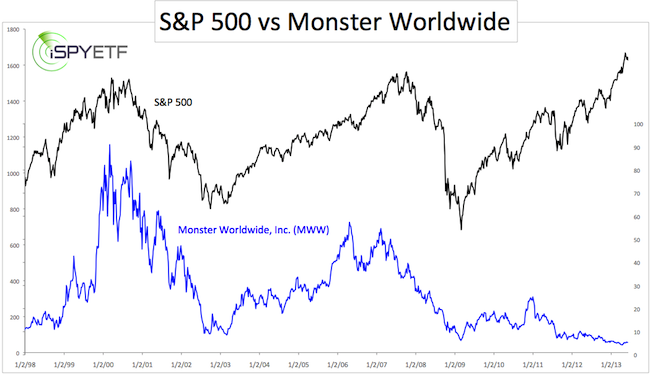

The chart below plots the S&P 500 against a company with its finger on the pulse of the job market – Monster Worldwide, Inc. (MWW).

Monster connects employers with job seekers at all levels in the Americas, Europe, and Asia. The company provides solutions and technology to simplify the hiring process for employers.

Admittedly, there are a number of non-job related reasons that may affect Monster’s stock price, but what explains the 90%+ drop from 55 in 2007 to 5.25?

It’s probably not much of a stretch to assume that the actual job recovery is not quite as strong as the unemployment numbers suggest.

Could it be that Mr. Bernanke receives many exclusive gift baskets from our friendly neighborhood too big to fail banksters stuffed with expensive wines, charts like this, and the petition to keep the free money coming?

|