There are always three sides to an argument: your side, my side and the truth.

There are also three sides to market analysis: A bullish spin, a bearish spin and the objective take.

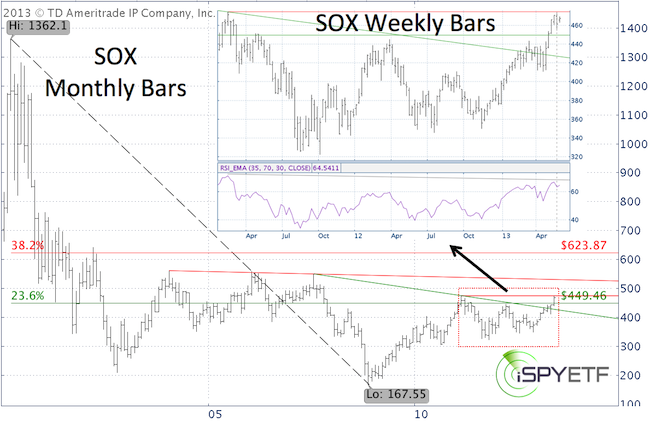

The bullish spin on the semiconductor index emphasizes the 180%+ rally from the November 2008 low. The bears will argue that the semiconductor sector is still a 190% gain away from its 2000 high and would have to double twice to reach new all-time highs.

What’s the objective take?

Fact is, the PHLX Semiconductor Index (SOX) barely retraced more than a Fibonacci 23.6% of the points lost from 2000 – 2008. Compared to other indexes, even technology indexes, that’s quite pathetic.

The PHLX Semiconductor Index still trades below its 2007 and 2011 high. In fact, last week prices were rebuffed by the 2011 high.

Furthermore, last week’s high came with a bearish RSI divergence on the daily chart and two bearish RSI divergences on the weekly chart

Bearish RSI divergences alone do not consistently foreshadow price highs, but meaningful price highs are generally accompanied by bearish RSI divergences.

Semiconductors’ trouble to surpass the 2011 high and a daily and weekly red reversal candle emphasize the bearish undertone of the RSI divergence.

The path of least resistance for the coming weeks is down. Support is at 449 and resistance at 475.

The SPDR S&P Semiconductor ETF (XSD) tracks an index similar to the PHLX Semiconductor Index.

The UltraShort Semiconductors ProShares (SSG) aims to deliver 2x daily inverse performance of the semiconductor sector, but trades on very low volume.

The Direxion Daily Semiconductor Bear 3x ETF (SOXS) trades on more volume, but is 3x short.

If you don’t want to miss future editions of the Weekly ETF SPY, >> sign up for our FREE Newsletter.

|