If you are reading this article there’s a good chance you’re thinking about buying or selling gold.

Before you trigger the trade, take a moment to learn about the ‘stuff’ you’re about to buy/sell. There are a lot of interesting little-known facts that may influence your decision. One of them is that the US government can and has confiscated gold.

History of Gold

The earliest recorded usage of gold dates back as far as 3000 BC, when Egyptian civilizations used gold for jewelry and decorative objects. Around 1500 BC, gold became a currency for international trade.

The first minted gold coin on record was produced in Asia Minor about 560 BC. In 1284 AD, the Republic of Venice introduced the gold ducat (called Zecchino), which soon became the most popular coin in the world.

Isaac Newton and the Gold Standard

In 1717, Isaac Newton (master of the London gold mint dating back to 1699) set the price of gold (NYSEArca: IAU), which lasted for the next 200 years. The Coinage Act of 1792 placed the United States on a silver/gold standard.

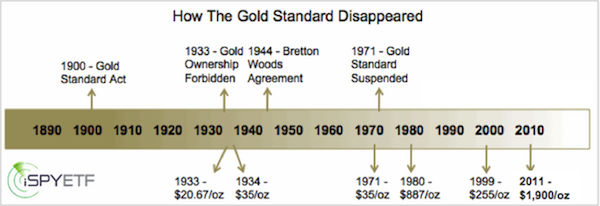

In 1900, congress enacted the Gold Standard Act, which required the U.S. Treasury to maintain a minimum gold reserve of $150 million. This meant that dollars could be converted into gold at any time.

Currency based on the gold standard represented real value since, unlike paper currency, gold is not someone else’s liability. Gold’s value is established by the willingness of people to pay a specific price.

The Gold Standard Crumbles

In 1933, President Roosevelt took the country off the gold standard, which allowed the government to print the money needed to deal with the aftermath of the 1929 – 1932 decline. Similar to QE today, which is driving the S&P 500 (SNP: ^GSPC) and Dow Jones (DJI: ^DJI) to all-time highs. Two years later, FDR fixed the price of gold at $35/oz.

The gold standard was restored to some degree via the Bretton Woods Agreement (BWA) made in 1944. The prominent features of the BWA were an obligation for each member country to adopt a monetary policy that maintained the exchange rate of its currency within a fixed value in terms of gold.

The International Monetary Fund (IMF) was established to bridge temporary imbalance of payments.

The United States rejected the idea of a supranational currency (called bancor) and requested to make the U.S. dollar the default reserve currency. The request was granted and the greenback overtook the role gold should have played.

To bolster faith in the dollar, the U.S. agreed to link the dollar to gold at the rate of $35/oz. At this rate, foreign governments and central banks (not U.S. citizens) were able to exchange dollars for gold.

A two-tiered price system for gold was established in 1968. The first tier was for transactions between governments, pegged at $35/oz, while other transactions (the second tier) would be supply/demand driven. The expected price range for second tier transactions was between $35 and $50/oz.

The Death of the Gold Standard

BWA remained in force until 1971. After a big drop in U.S. gold reserves and a large increase in foreigners’ claims on U.S. dollars, President Nixon suspended the convertibility of the dollar to gold (known as Nixon Shock).

Since then, the U.S. dollar (and other currencies) has been “floating” without gold backing. 1971 was the beginning of a wild expansion of fiat currency and not to forget, fiat credit.

Gold Can be and Has Been Confiscated in the U. S.

Unknown to many Americans, the U.S. government has the right to confiscate precious metals held in a safety deposit box. In fact, President Roosevelt exercised this right in April 1933.

After declaring a banking holiday, FDR announced the following, as per the authority given to him by Section 5(B) of The Act of Oct. 6th, 1917:

“Pursuant to the above authority, I hereby proclaim that such gold and silver holdings are prohibited, and that all such coin, bullion or other possessions of gold and silver be tendered within fourteen days to agents of the Government of the United States for compensation at the official price, in the legal tender of the Government. All safe deposit boxes in banks or financial institutions have been sealed, pending action in the due course of the law. All sales or purchases or movements of such gold and silver within the borders of the United States and its territories, and all foreign exchange transactions or movements of such metals across the border are hereby prohibited.”

Compensation in the legal tender of the government meant that citizens were paid the official price of $20.67/oz. Following the confiscation, the dollar (NYSEArca: UUP) was devalued by 40% and the price of gold (NYSEArca: GLD) was readjusted and fixed to $35/oz.

How Much Gold is There?

According to the World Gold Council, there are only 163,000 metric tons (one metric ton equals 1,000 kilograms and is 10% heavier than the standard U. S. ton) of gold in circulation. This is just about enough to fill two Olympic-size swimming pools.

At $1,400/oz, all the gold ever mined would amount to roughly $7.4 trillion, or less than one ounce of gold for every person in the world. Gold is measured in troy ounces. One troy ounce equals 31.10 grams, while a regular ounce equals 28.35 grams.

Is Now the Time to Buy Gold?

The Profit Radar Report has been expecting to see a double bottom in gold around $1,250 – 1,300/oz. Click here for the most recently published free gold analysis on iSPYETF.com.

Premium analysis of gold and the SPDR Gold Shares (GLD) is provided via the Profit Radar Report.

|