Investors are forgetful and the market is relentless. The Cypriot Bailout was another reminder about gold’s safe haven advantages over fiat currency.

In times past, gold would have soared on similar economic scares. But not this time. Gold today trades around the same level as two weeks ago.

While the Cypriot Bailout failed to deliver the fuel needed for higher targets, gold could be getting a positive boost from elsewhere.

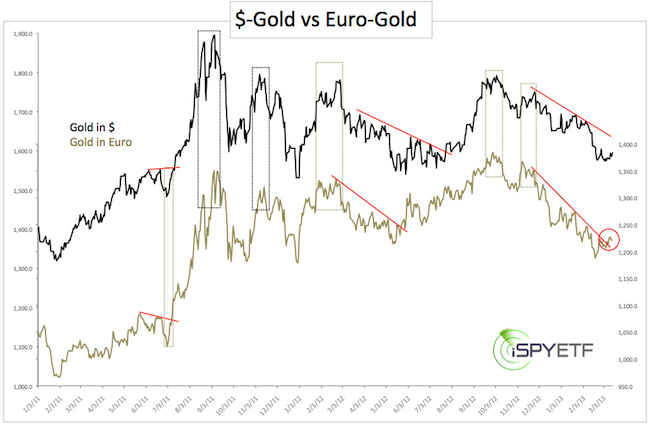

Gold prices measured in euros just staged a technical breakout above resistance (red circle). Gold measured in US dollars is trading well below similar resistance.

The red lines in the chart below mark previous times where euro-Gold broke above resistance. Euro-gold proved to be the bullish canary every time.

Price divergences between euro and dollar-Gold appear frequent at different degrees. The dotted boxes highlight some of the price divergences at larger turning points. More often than not, the euro pattern (gold colored boxes) sets the stage for the next move.

Based on the correlation between euro-and dollar-gold prices, higher prices seem likely (sentiment is sending the same message).

The question is when?

The Profit Radar Report has been expecting higher prices for gold. However, another new low below 1,555 would look like a more legitimate bottom. That’s why the March 3, update stated that: “Aggressive investors afraid of losing out on a possible up move may go long.”

One reason I would like to see a new low is the lack of an obvious bullish price/RSI divergence at the February 21 low (@1,555). There was a minor divergence, but the bigger the divergence, the bigger the confidence in the longevity of the bottom.

Over the past week gold prices have struggled to move past Fibonacci resistance. The reluctance to move beyond resistance (despite the ‘fear catalyst’ from Cyprus) and the lack of an obvious RSI divergence at the recent low, conflict with the bullish breakout of euro-Gold.

Since I’m always looking for low-risk entry points, buying gold at lower prices would represent a much more attractive risk/reward ratio.

Long gold ETF options include the SPDR Gold Shares (GLD) and iShares Gold Trust (IAU).

|