| |

Articles

|

By Simon Maierhofer | Tuesday April 28, 2015

Like gold nuggets, high probability setups are rare and precious. They come with a very high probability of being profitable. Here is how to identify high probability setups, and one recent example.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Tuesday April 28, 2015

Flashback: In QE times, bad news was good news, because it meant more QE. Today: Bad news (i.e. latest unemployment numbers) is good news, because it means lower interest rates for longer. But, history shows rising rates aren’t as scary.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Monday April 27, 2015

The Nasdaq QQQ ETF just shot out of a multi-week bullish flag consolidation pattern. Here is a closer look at the pattern, the potential up side target and emerging warning signs.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Monday April 27, 2015

One of the most fascinating AAPL chart formations telegraphed AAPL’s up side pop. The pattern suggests further up side. Long-term resistance levels form a very plausible up side target, and potential reversal zone.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Friday April 24, 2015

For the first time in 15 years, the Nasdaq closed at a new all-time high. The S&P 500 (almost) did too. Since ‘sell in May, and go away’ is right around the corner, here’s what happened previously when the Nasdaq and S&P 500 both set new all-time highs in the month of April.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Tuesday April 21, 2015

Although the S&P 500 failed to overcome resistance and reach new highs, a ‘look under the hood’ shows that buying pressure is actually stronger than it appears. Here’s what that’s good and bad news.... >> READ MORE...

|

| |

|

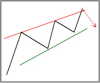

By Simon Maierhofer | Monday April 20, 2015

Unlike the Dow Jones and S&P 500, the broad based NYSE Composite Index actually rallied to new all-time highs. The subsequent island reversal, and a bearish wedge provide a tell tale sign and low-risk trade setup.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Friday April 17, 2015

The Russell 2000 recorded a new all-time high just before erasing 13 days worth of gains. One bearish formation – once validated – could unlock the potential for much greater losses. Here’s a look at an intriguing chart.... >> READ MORE...

|

| |

|

By Simon Maierhofer | Wednesday April 15, 2015

"Are we there yet?” There probably isn’t a parent in the world that hasn’t heard this question. However, this time around investors are wondering when the boring and seemingly endless sideways trading is coming to an end. Are we there yet?... >> READ MORE...

|

| |

|

By Simon Maierhofer | Tuesday April 14, 2015

2015 stock performance has been more vexing than prior years. In terms of long-term seasonal patterns, 2015 is shaping up to be very unusual. Seasonality suggests a big move ahead. Will the S&P 500 deliver?... >> READ MORE...

|

| |

|

Previous | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 Next

|

|

|

|