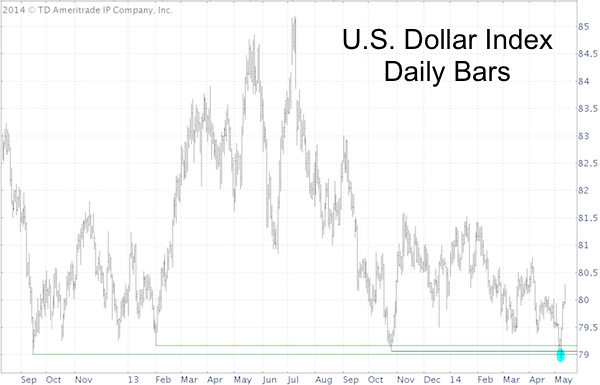

For well over six months the U.S. dollar, euro, and EUR/USD have been trading in a frustratingly tight range, but last week saw some noteworthy action.

On May 8, the U.S. dollar index traded below 18-month support (blue circle) at 79.

Based solely on technicals, the May 8 dip should have led to more selling.

However, the May 7 Profit Radar Report, which recommended a small long U.S. dollar position earlier, outlined why a dip below 79 might be a bear trap:

“The U.S. dollar is teetering just above important support at 79. Based solely on technicals, a drop below 79 would be a sell signal and unlock a target around 76. However, a drop below 79 could also turn into a bear trap. Here’s why:

There is generally an inverse relationship between the dollar and U.S. stocks. Although this relationship comes and goes, the seasonal pressure on stocks should be positive for the dollar (more details on stock seasonality below).

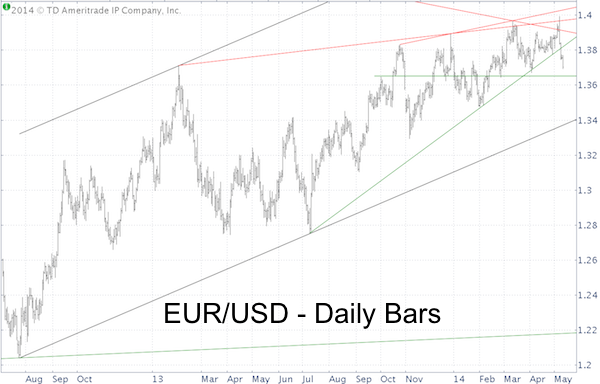

Euro cycles will soon turn temporarily bearish.

Euro is close to up side target at 1.40.”

No doubt the quick headfake below 79 triggered an avalanche of stop orders, which fueled the vigorous rally since. The corresponding U.S. dollar ETF is the PowerShares DB US Dollar Bullish ETF (NYSEArca: UUP).

As mentioned in the May 7 Profit Radar Report, one of the reasons the dollar down side was limited, is because the EUR/USD was close to our up side target at 1.40.

The chart below shows EUR/USD (CCY: EUR/USD) resistance around 1.40 and a violent reversal from the 1.3992 high. The most closely correlated euro ETF is the CurrencyShares Euro Trust (NYSEArca: FXE).

Last week’s reversals may well be the beginning of a new trend, but it will take a move above short-term resistance to unlock new targets.

The May 7 Profit Radar Report also mentioned seasonal pressure for stocks. Everyone knows about the chewed-out ‘sell in May and go away’ adage.

Here is why to expect seasonal weakness for stocks, but first we’ll have to wait for all the ‘early adopters of the sell in May strategy’ to get burned. More info here:

S&P 500: 3 Reasons to Expect the May Blues … But Not Yet

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|