She isn’t even confirmed as Bernanke successor yet and is already driving stock prices higher – Janet Yellen.

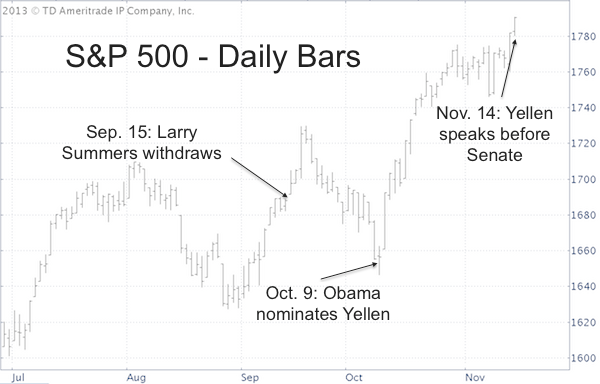

On Wednesday, October 9 (after market hours), President Obama nominated Janet Yellen to chair the Federal Reserve board. On the next morning the S&P 500 (SNP: ^GSPC) soared 20 points within the first hour of trading.

Yellen’s Senate hearing today pumped the S&P 500 Index another 10 points.

Even Larry Summers’ withdrawal from the Fed Chairman race on September 15 (Sunday) caused a temporary 40-point melt up in the S&P 500.

The S&P 500 chart below chronicles the still brief but already passionate affair between the likely new Fed Chair to be and QE-dependent Wall Street.

Yellen is good for stocks and rising stocks are good for the President. No wonder Mr. Obama wants Yellen to chair the team of financial alchemists.

Did President Obama go as far as lie about Yellen’s qualifications?

Obama About Yellen

In a glowing endorsement, President Obama praised Yellen’s keen understanding of the markets and her ability to call it as she see’s it. He said:

“Janet is renowned for her good judgment. She sounded the alarm early about the housing bubble, about excesses in the financial sector and about risk of a major recession.”

Based on Obama’s statement, Yellen is a bit brighter than Mr. Bernanke, who showcased his smarts many times, here’s just one instance:

May 17, 2007: “We believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

Yellen About Herself

Back to Yellen. Did she really see the trouble in the financial sector brewing?

In testimony to a congressional committee in 2010, Yellen said the following:

“For my own part, I did not see and did not appreciate what the risks were with securitization, the credit ratings agencies, the shadow banking system... I didn't see any of that coming until it happened.”

Does this mean President Obama lied?

Lying is a strong word. Perhaps Mr. Obama was referring to Fed transcripts from December 2007, where Yellen is on record to have said:

“The possibilities of a credit crunch developing and of the economy slipping into a recession seem all too real. At the time of our last meeting, I held out hope that the financial turmoil would gradually ebb and the economy might escape without serious damage. Subsequent developments have severely shaken that belief.”

There’s a difference between a “shaken belief” in a strong economy and seeing a financial meltdown.

Courtesy of broken Obamacare promises we know the President is cabable of lying. But my job is not if and when the President lied about what, my job is to navigate the stock market for subscribers of the Profit Radar Report.

As such, I was able to dig up an official report (actually written by the Federal Reserve) that details just how much QE and in particular the regular FOMC meetings, artificially inflate the S&P 500 (NYSEArca: SPY).

The results are stunning and revealed here:

New York Fed Research Reveals that FOMC Drove S&P 500 xx% Above Fair Value?

HINT: Look at the date of the article/report!

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|