Baron Rothschild's famous words encourage investors to buy when there’s blood on the streets. What about when there’s oil on the street?

Pull up the Hummer and Suburban, because oil (and gasoline) is the cheapest it’s been in well over four years.

According to many analysts, oil is doomed to fall much further. One price target pegged oil at $30/barrel, another 60% lower than today.

Unless you’re Russia, Saudi Arabia or perhaps a hardcore Prius driver, there’s nothing wrong with low prices, but some charts suggest that the oil/energy sector may be getting ready for a comeback.

The Energy Select Sector SPDR ETF (NYSEArca: XLE) has traversed within a defined trend channel from 2009 until today. As the weekly XLE bar chart shows, XLE recently dropped towards the lower end of the channel.

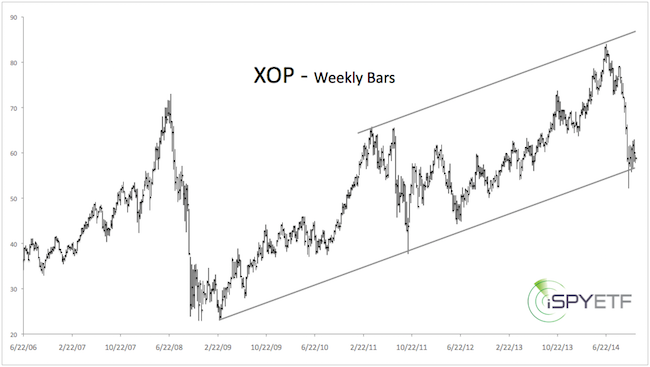

Essentially the same is true for the SPDR S&P 500 Oil & Gas Exploration & Production ETF (NYSEArca: XOP). XOP more deliberately tested channel support and is trading just above it.

Technical support areas, such as the ones shown above, don’t guarantee a change of trend, but they do highlight price levels where a change of trend is more probable.

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

The third chart shows the XLE:S&P 500 ratio. XLE underperformed the S&P 500 since April 2011. The gray trend channel suggests that the days of XLE’s underperformance may be numbered.

The November 5 Profit Radar Report wrote that: “We are looking for potential opportunities to buy large caps (Dow Jones, S&P 500) and possibly materials (XLB) and Energy (XLE).”

We got to pick up XLB, which has had a very nice run, and are waiting for a low-risk buy trigger for XLE. It looks like we’re getting close. Continued coverage will be provided via the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|