A one-week decline doesn’t wipe out a five-year bull market, but it can ruffle some bullish feathers. That’s exactly what happened last week.

Aside from this chart, few indicators suggest an immediate end to stocks new-found attraction for lower prices.

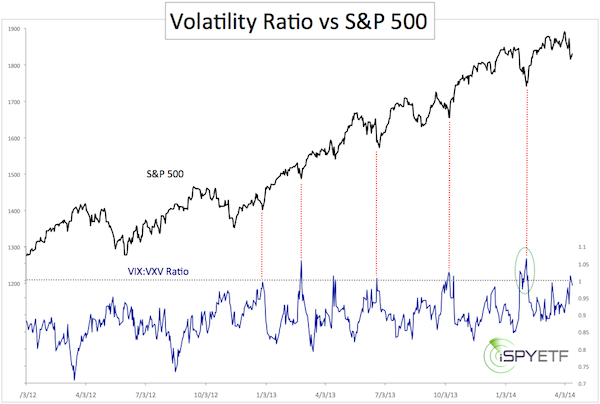

The chart plots the S&P 500 (SNP: ^GSPC) against the VIX:VXV ratio.

The VIX (NYSEArca: VXX) is a gauge of expected volatility for the next month.

The VXV is a gauge of expected volatility for the next three months.

We’ve previously dubbed this the ‘Incredible VIX Market Bottom Indicator,’ because prior readings above 1 (= expected 1-month volatility > 3-month volatility) have coincided with every S&P 500 bottom since 2012.

Now, once again, the VIX:VXV ratio has spiked above 1.

This is good news if the S&P (NYSEArca: SPY) follows the bullish 2013 pattern, but not every year can be like 2013 (I personally think we might see another VIX:VXV hook higher like in February - green circle).

There’s another, even better, explanation why stocks rallied today (and whether this is a ‘real’ or ‘fake’ bounce. More details here:

Don’t Get Fooled by S&P 500 Bounce

There are two potent reasons why this VIX spike may not have the same results now as it did in 2013. More details here:

MACD Triggers the Year’s Most Infamous Sell Signal (make sure to look at date of article)

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|