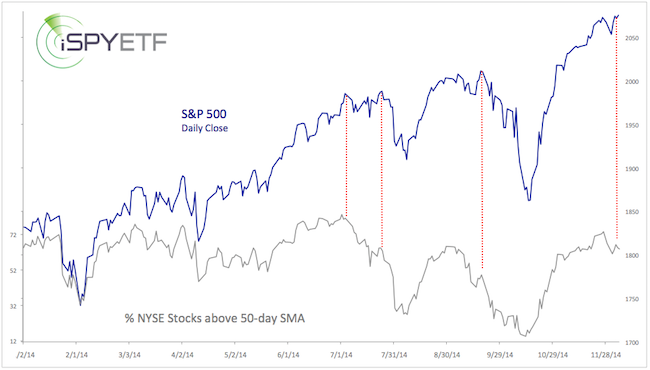

Sunday’s Profit Radar Report featured the chart below along with the following warning:

“On Friday the S&P 500 reached a new intraday and closing all-time high. The percentage of NYSE stocks above the 50-day SMA did not confirm Friday’s price high. That’s the biggest divergence between price and % of stocks > 50-day SMA since this rally started.

The success of this rally now rests on the shoulders of fewer companies. This doesn’t mean it has to end, but distributing weight on fewer shoulders generally accelerates the process of tiring.”

Near-term support is around 2,040 – 2,030. I’m not yet sure if and how much lower the S&P 500 will drop, but the deeper the correction, the better the next buying opportunity.

It’s worth noting that the % of stocks above their 50-day SMA was the only indicator I follow that actually showed a small bullish divergence at the October 15 low. I’m not sure if this correction will be long enough to create a bullish divergence, but if it does, it shouldn’t be ignored.

For the first time this year, small cap stocks look actually more attractive than large cap stocks. The iShares Russell 2000 ETF (NYSEArca: IWM) has the potential for a bigger year-end pop compared to the SPDR S&P 500 ETF (NYSEArca: SPY).

Continued analysis and buy/sell signals for SPY and IWM will be available to subscribers of the Profit Radar Report.

Recent Profit Radar Report analysis for the Dow Jones is available here: Dow Jones Repelled by 12-year 'Insider' Resistance

Recent Profit Radar Report analysis for the Nasdaq-100 is available here: Nasdaq-100 'Stuck on an Island'

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF to get actionable ETF trade ideas delivered for free.

|