|

|

| S&P 500 Seasonality About to Hit Weak Pocket |

| By, Simon Maierhofer

|

| Tuesday February 17, 2015 |

|

|

|

|

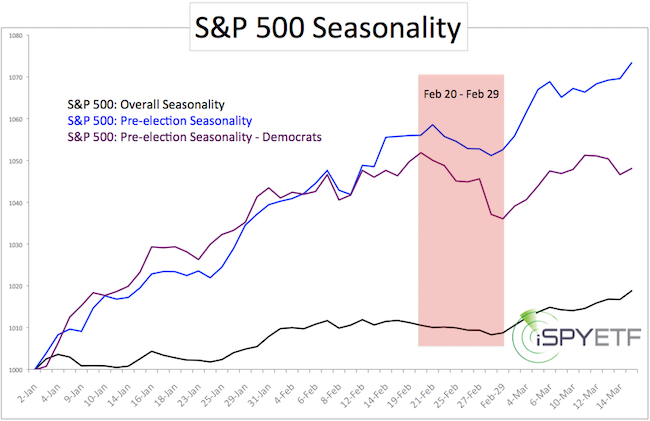

| Seasonality is not the only force to drive stocks, but it’s one of the indicators I follow. The S&P 500 seasonality chart (based on 64 years of history) shows four notable weak spots, one of them is in February. |

|

Seasonality is not the only force to drive stocks, but it’s one of the indicators I follow. The S&P 500 seasonality chart (for pre-election years) shows four notable weak spots (seasonality is based on 64 years of daily closing prices).

One of them, although not very intimidating, is the second half of February (others are in May, July and October – a full year seasonality chart is available via the Profit Radar Report).

Looking for more continuous S&P 500 analysis? >> Sign up for the FREE iSPYETF e-Newsletter

The chart below highlights the February weak spot.

Purely based on seasonality, the S&P 500 (NYSEArca: SPY) is unlikely to follow through on its bullish technical break out, at least not in February.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013 and 17.59% in 2014.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|

|

|

|

|

|

|

|

|

|

|

|

|

|