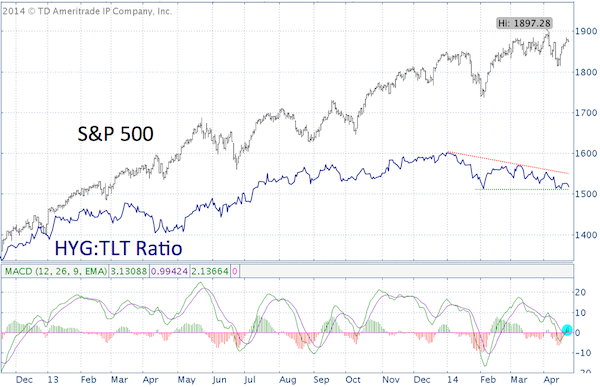

MACD for the S&P 500 (SNP: ^GSPC) turned positive on Tuesday.

This is mildly significant because it coincided with the S&P 500 overcoming a technical short-term ‘hurdle’ (or resistance) at 1,874.

As the April 20 Profit Radar Report brought out: “A move above S&P 1,874 will rejuvenate the bullish camp.”

However, there’s something odd about this MACD buy signal. It is not confirmed by the kind of ‘risk on’ mentality usually needed to drive the S&P 500 (NYSEArca: SPY) much higher.

I am using the HYG:TLT ratio as proxy for the ‘risk on – risk off’ mentality.

HYG is the iShares iBOXX $ High Yield Corporate Bond ETF (NYSEArca: HYG). TLT is the iShares 20+ Year Treasury Bond ETF (NYSEArca: TLT).

A higher ratio shows that investors prefer risk (HYG) over safety (TLT) and vice versa.

Right now investors are about as risk averse as they’ve been in a while (July 2013).

The red and green lines show that the HYG:TLT ratio is sandwiched between support and resistance.

This could foreshadow a number of things, one of them is another fake S&P 500 pop.

There are many pieces to the market forecasting puzzle. Two more can be found here:

Could Nasdaq VIX 'Saucer Breakdown' Lead to Waterfall Decline?

Bi-Polar Investors Dumb Stocks on Fear of Bull Market End

Key near-term support/resistance levels and price targets are provided via the Profit Radar Report.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|