The seven most notorious words of the financial industry: “Past performance does not guarantee future results.”

In other words, anyone buying a hero and ending up with a zero has no one to blame but him or herself.

+65%, +55%, +38% are the digits of the three hottest ETFs right now (based on 3-month return). Does it make sense to chase those ETFs?

The trend is your friend until it bends, so chasing ETF hot shots isn’t always a terrible idea, but being aware of three common pitfalls may reduce embarrassment at the water cooler investment chat.

Peril #1: Leverage

Leveraged ETFs usually crowd out any "Top 10” performance list. Leveraged ETFs are ETFs on steroids. Currently 9 out of the 10 best performing ETFs are leveraged or leveraged short ETFs.

Leverage can be a blessing and a curse. It’s important to know that leveraged ETFs - like carnival mirrors - always skew the real condition of the underlying sector. For more details on the dangers and delights of leveraged ETFs click here: The Must Know Basics of Short and Leveraged ETFs

Weeding out all leveraged (short) ETFs and zooming in on ‘pure ETFs’ will offer a more accurate picture of the best performing sectors and their ETFs.

Complex Analysis Made Easy - Sign Up for the FREE iSPYETF E-Newsletter

Peril #2: FOMO

FOMO (fear of missing out) is a powerful motivator, but it’s a terrible reason to buy. If the sole reason for buying a hot ETF is fear of missing out on more gains, it’s probably a bad idea. FOMO is not an investment strategy.

Strong momentum, persuasive fundamentals, or yet unreached up side targets are better reasons to buy an ETF that’s already trading well above its low.

Peril #3: Performance Chasing & Trend Reversals

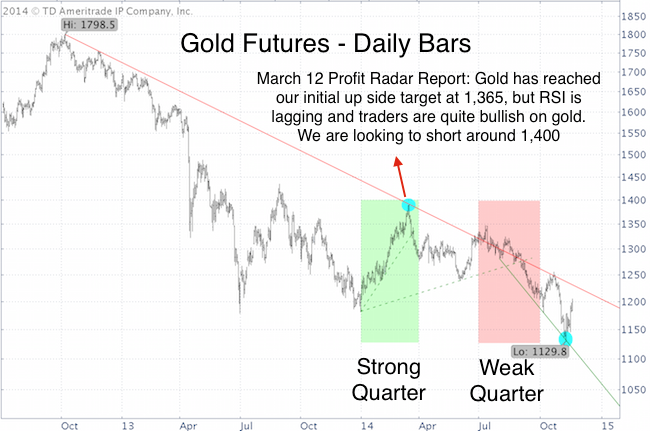

Here’s a real life example of the perils of performance chasing.

Gold was one of the hottest assets in Q1 2014, but one of the worst performers in Q3.

The SPDR Gold Shares ETF (NYSEArca: GLD) was up as much as 15.13% in March. It's fallen as much as 17.96% since. The VelocityShares 3x Long Gold ETN (NYSEArca: UGLD) was up as much as 50.69%, followed by a 46.95% drop.

Burnt trend chasers still hear the ringing of those chewed out Wall Street phrases in their ears:

-

“Past performance does not guarantee future results”

-

“The trend is your friend until it bends”

But how can you determine how long a trend is going to last.

The gold chart features an observation made by the Profit Radar Report on March 12, three trading days before gold rolled over: “Gold has now reached our initial up side target at 1,365. RSI is lagging price and traders are quite bullish on gold. We are looking to short around 1,400.”

Bullish sentiment and chart resistance capped gold’s up side in March (blue circle).

It appears that bearish sentiment and chart support ended gold’s slide on November 7 (blue circle).

Having a pulse on investor sentiment and technical support/resistance levels does not guarantee winning trades, but it generally prevents against joining the performance chase at the worst of times.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|