“Fiscal cliff hopes buoy the markets” and “Fiscal cliff concerns drive stocks lower.”

The fiscal cliff is everywhere and thus far I’ve refused to write about. Everyone talks about this cliffhanger, so isn’t it already priced in? Is the fiscal cliff really as bad as it’s hyped up to be? Here’s my 2-cent contribution to the subject.

First off, fiscal cliff is the wrong label. It should be dubbed a fiscal shot in the foot. It’s a self-inflicted problem, or better yet, a problem imposed by incapable politicians upon the American public.

The Fiscal Cliff – A Twofold Problem

Neither the annual deficit nor the even bigger U.S. debt problem are new issues. It’s just that the divisive political climate moves politicians to hang out our dirty financial laundry in plain sight and turn previously discreet negotiations into public spectacles.

The debt ceiling issue came up in July/August 2011. At the time, the United States had reached its $14 trillion debt ceiling. Republicans and Democrats couldn’t agree on a balanced budget, so they simply increased the debt ceiling by $2.4 trillion – or 17% - to $16.4 trillion.

To make their failure and the new debt ceiling increase more palatable (and to give the public hope that the next round of negotiations will be different), both parties agreed on automatic spending cuts and tax increases. Those spending cuts are slated to take effect January 1, 2013 (called sequestration).

The cuts/hikes one two punch is one component of the fiscal cliff. That the new $16.4 trillion deficit ceiling is no longer adequate is the second. The fact that the U.S. deficit increased 17% in 18 months should be the third (but it's ignored for now).

Will Washington Get it Done?

The token deal of August 2011 came last minute and obviously just postponed the inevitable. It even made things worse.

Standard & Poor’s downgraded the U.S. credit rating because the (2011) budget debate showed that: “American’s governance and policymaking is becoming less stable, less effective, and less predictable than what we previously believed” (quote from Standard and Poor's).

We are already hearing statements like “the cuts/hikes don’t take immediate effect” or “congress can change laws retroactively,” so an early or even timely solution seems unlikely.

Is the Fiscal Cliff Really that Bad?

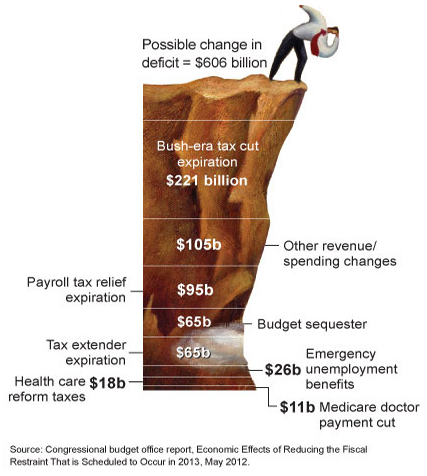

Can stocks fall off the fiscal cliff? They sure can. The image below explains the financial impact of the tax cuts.

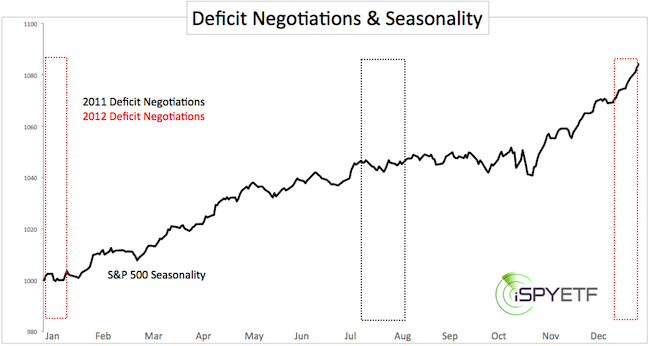

Any fallout should be cushioned by bullish seasonality. The 2011 deficit negotiations and S&P downgrade happened during one of the weakest periods of the year. The 2012 negotiations occurred during one of the strongest times of the year.

Other factors to consider are how much of the worst-case scenario is already priced in? Fear over an increase of dividend taxes appears to have driven the post election sell off (the SPDR S&P 500 ETF- SPY - fell 9% from its September high).

Lets not kid ourselves, higher taxes and lower government spending - and any combination thereof - is bad for the economy. There will be consequences and the stock market will react.

But right now the reaction is expected. The stock market likes to prey on unsuspecting investors (not prepared ones). The stock market may wait for a more "opportune" time to douse investors.

Here's how I approach the fiscal cliff: I don't know if the negotiations will be fruitful or embarassing. I don't know how much of the bad news is already priced in. But I do know that a move above resistance will unlock more up side, just as a move below support will lead to increased selling. With strong December seasonality the up side deserves the benefit of the doubt until proven otherwise.

I rather be guided by price action around support/resistance than by politicians. Key support and trigger levels along with a multi-month forecast is outlined in the Profit Radar Report.

|