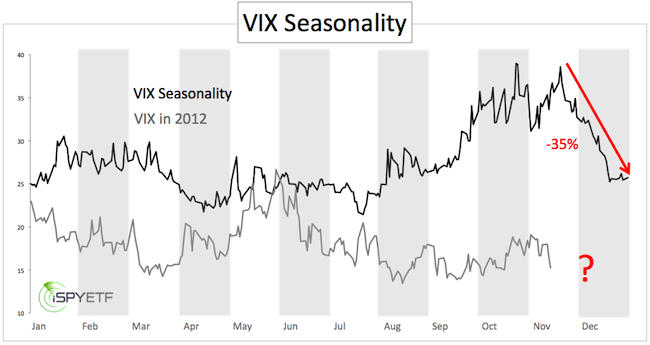

November/December is statistically the season for the best VIX trade of the year. On average, since 1990, the VIX drops 35% from Thanksgiving to Christmas.

The chart below illustrates the sharp VIX (Volatility Index) move from the November high to the December low. This year however, investors have to deal with a caveat.

No Slam Dunk – The VIX is in a Funk

The VIX is in a funk. How so? The VIX resisted the usual tendency to rise into Thanksgiving and is currently trading near its low for the year.

This is even more of a head scratcher considering that the S&P 500 just dropped as much as 9.5%. Due to the inverse correlation between VIX and S&P, the VIX should have soared for much of November.

Quite to the contrary, the VIX actually dropped during the time the S&P fell hardest (November 7 – 16).

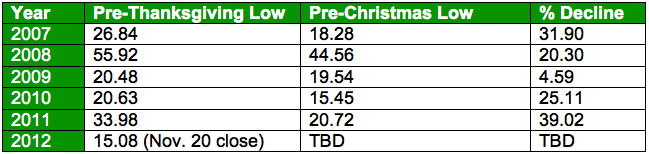

The table below shows the VIX closing price of the day before Thanksgiving and the pre-Christmas low (which has occurred between December 21 and 23 the past five years).

A measured 35% drop from this year’s pre-Thanksgiving close would draw the popular volatility measure below 10, a level last seen in February 2007. This isn’t impossible, but it’s improbable.

In short, the VIX trade doesn’t look like a high probability trade this season. Even at the best of times, it’s difficult to monetize moves of the fear index.

Tough to Profit from the VIX

That’s because the VIX itself can’t be traded. There are tradable vehicles that have been created, but they all have complex idiosyncrasies. Trading the VIX is almost like catching the wind. Many of those unseen idiosyncrasies cause price deterioration and make it difficult to capture profit.

The three vehicles that make trading the VIX possible are:

1) Options 2) Futures 3) ETFs/ETNs.

VIX options are subject to price decay. VIX futures usually find themselves in a state of contango or backwardation. VIX ETFs or ETNs are based on either VIX options or futures (futures are more commonly used).

Contango is a condition where the VIX futures (price of VIX in the future) trade at a higher price than the VIX spot price (current price). Contango is in essence a premium. The further away the expiration of the futures, the higher the premium.

Imagine buying a car and trying to sell it for a profit. As a private party you have to pay sales tax (7.25% in CA). If you buy a car for $10,000, you have to sell it for more than $10,725 (purchase price plus tax) to make a profit. Contango is like the sales tax.

Some research on the iPath S&P 500 VIX Short-term Futures ETN (VXX – the most heavily traded VIX ETN/ETF) suggests that the cost of contango is about 0.25% - 0.45% per day. Contango usually occurs when the VIX trades below 25.

When the VIX rises above 25 it usually suffers from backwardation. Backwardation is the opposite of contango, and happens when the spot price is higher than the front month futures. While contango eats into returns, backwardation can enhance the return of VXX.

VIX Lessons

While we likely won’t trade the VIX this year, the VIX research isn’t totally wasted.

The VIX suggests rising prices and some sort of a year-end rally.

This may provide trading opportunities for the S&P 500 and other equity indexes.

|