As my regular readers and subscribers to the Profit Radar Report know, I follow a ton of indicators.

Most of those indicators fall into one of three category buckets: Technicals, sentiment, seasonality.

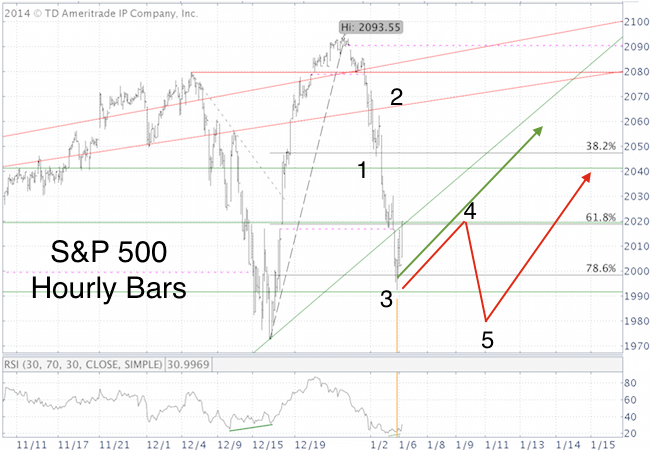

In the December 21 Profit Radar Report I offered two projections based on Elliott Wave Theory. EWT is one of the more exotic technical indicators, but at times it offers insight no other type of analysis can provide.

The December 21 Profit Radar Report stated that: “Stocks may hit an inflection point once the S&P 500 and Russell 2000 record new all-time highs. About 25% of funds allocated for trading equities are tied up in the iShares Russell 2000 ETF (NYSEArca: IWM, Materials Select Sector SPDR ETF (NYSEArca: XLB) and VelocityShares Daily Inverse VIX ETN (NYSEArca: VXX). We’ll keep this allocation until we see new all-time highs. According to Elliott Wave Theory, the current rally may be followed by a 10% correction.”

Below is the chart with the two projections featured in the December 21 Profit Radar Report.

We sold XIV on December 23 for a profit.

By December 30, the S&P 500 and Russell 2000 delivered new all-time highs and we closed our XLB and IWM positions with gains because the odds started to favor the more bearish projection.

Over the past two years corrections have generally been shallow, and it remains to be seen whether the S&P 500 (NYSEArca: SPY) will fall as low as projected in the chart, but for now we are glad to be out of stocks. Yesterday's Profit Radar Report pegged the initial S&P down side target at 2,016.

"UPDATE: January 6 Profit Radar Report (7am PST): The low occurred at support, sports a small bullish RSI divergence and could count as a 3 wave A-B-C correction. From here we should see a bounce. The chart illustrates two options (see chart below). I think that odds favor the red projection."

A detailed 2015 S&P 500 forecast will be available (to subscribers of the Profit Radar Report) soon.

A look at VIX seasonality and why the VIX was doomed to rally over Christmas and New Year is available here:

New Year's VIX Hangover Explained

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report presents complex market analysis (S&P 500, Dow Jones, gold, silver, euro and bonds) in an easy format. Technical analysis, sentiment indicators, seasonal patterns and common sense are all wrapped up into two or more easy-to-read weekly updates. All Profit Radar Report recommendations resulted in a 59.51% net gain in 2013.

Follow Simon on Twitter @ iSPYETF or sign up for the FREE iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|