Do you prefer a hand saw or a chain saw? It probably depends on the job. It’s not that one is better than the other, they are just different.

The same can be said about ETFs and leveraged (short) ETFs.

Broad market ETFs like the S&P 500 SPDRs (NYSEArca: SPY), Dow Jones Diamonds (NYSEArca: DIA) or Nasdaq QQQ (Nasdaq: QQQ) track their underlying indexes more closely than leveraged ETFs.

Leveraged ETFs on the other hand are more powerful. But with extra power – imagine the chain saw – comes extra risk.

Some investors prefer the simplicity and easy handling of a ‘hand saw.’ Others, usually more experienced investors, are familiar and comfortable with the risks of a ‘chain saw.’

There is no right or wrong, but there are risks every investor needs to be aware of before using a ‘chain saw’ or leveraged (short) ETFs.

Leveraged ETFs are designed to multiply (2x or 3x) the daily performance of the underlying index.

Short ETFs are designed to deliver the inverse daily performance of the underlying index. Leveraged short ETFs aim to multiply (2x or 3x) the inverse daily performance of the underlying index.

To attain leveraged and/or inverse performance, fund companies may utilize futures contracts, swap agreements and options. This differs from broad market ETFs, which simply own shares of the companies that make up the index.

Relying on stock substitutes (futures, swaps and options) causes tracking error. Additionally, the leveraging component creates its own tracking error.

Imagine a picture of a famous landmark compared to a drawing of the same landmark. There are bound to be differences.

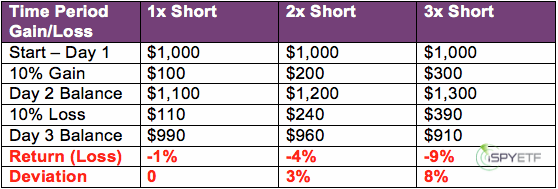

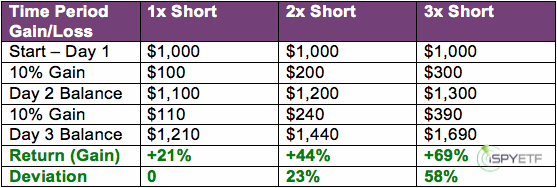

Leveraging Tracking Error

The reason for the leveraging tracking error is purely mathematical and often overlooked. The chart below illustrates how leveraged daily performance can:

1) Eat away returns in a range bound market.

2) Compound returns in a trending market.

Replication Tracking Error

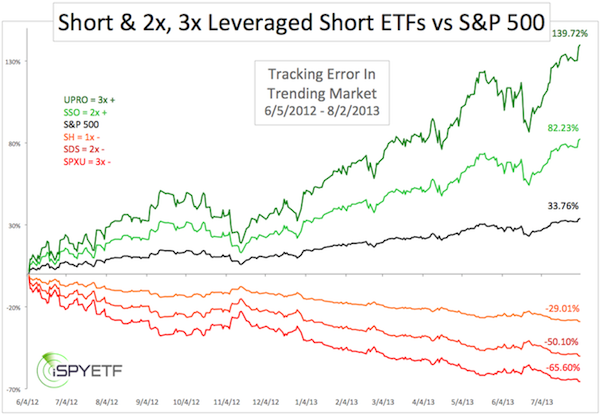

A picture says more than a thousand words, so let’s look at some charts to see how well leveraged (short) ETFs track their underlying index.

The charts below plot the S&P 500 (NYSEArca: SPY) against the following leveraged (short) ETFs:

Ultra S&P 500 ProShares (NYSEArca: SSO) = 2x long

UltraPro S&P 500 ProShares (NYSEArca: UPRO = 3x long

Short S&P 500 ProShares (NYSEArca: SH) = 1x short

UltraShort S&P 500 ProShares (NYSEArca: SDS) = 2x short

UltraPro Short S&P 500 ProShares (NYSEArca: SPXU) = 3x short

Leveraged (Short) ETFs in a Trending Market

Largely due to the leveraging tracking error, leveraged (short) ETFs tend to track their underlying index better in a trending market. The time frame illustrated in the first chart below is June 5, 2012 – August 2, 2013.

Keep in mind that leveraged (short) ETFs are designed to replicate the DAILY performance not multi-month performance. Nevertheless, the 1x short, 2x short and 2x long ETFs did a decent job tracking the S&P over this 14-month span. Even the 3x short and 3x long ETFs were in the ballpark range.

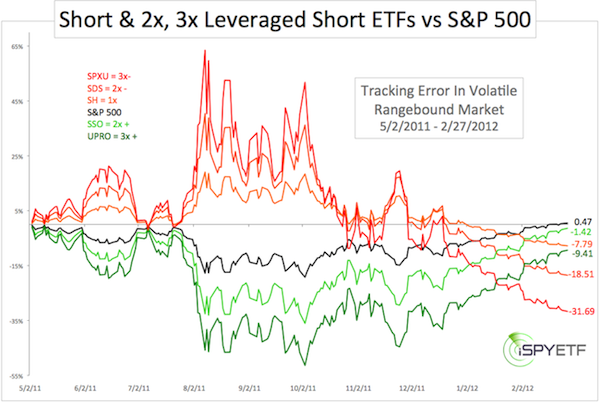

Leveraged (Short) ETFs in a Volatile Rangebound Market

Volatile rangebound markets wreak havoc on the longer-term performance of leveraged (short) ETFs as the chart below attests.

After much volatility (including the Flash Crash) the S&P 500 closed 0.47% higher on February 27, 2012 compared to May 2, 2011. None of the shown leveraged (short) ETFs replicated the S&P correctly.

Conclusion

Leveraged (short) ETFs are powerful tools when used correctly. Remember that chain saw accidents are rarely the fault of the chain saw, but of the one handling it.

Being aware of the idiosyncrasies of leveraged (short) ETFs reduces the risk of 'accidents.'

Did you know that the Federal Reserve (via a recent study) is preemptively blaming leveraged ETFs for a 1987-like market crash. Sounds ridiculus, but it's true. View the Federal Reserves accusatory study of leveraged ETFs here.

Simon Maierhofer is the publisher of the Profit Radar Report. The Profit Radar Report uses technical analysis, dozens of investor sentiment gauges, seasonal patterns and a healthy portion of common sense to spot low-risk, high probability trades (see track record below).

Follow Simon on Twitter @ iSPYETF or sign up for the iSPYETF Newsletter to get actionable ETF trade ideas delivered for free.

|